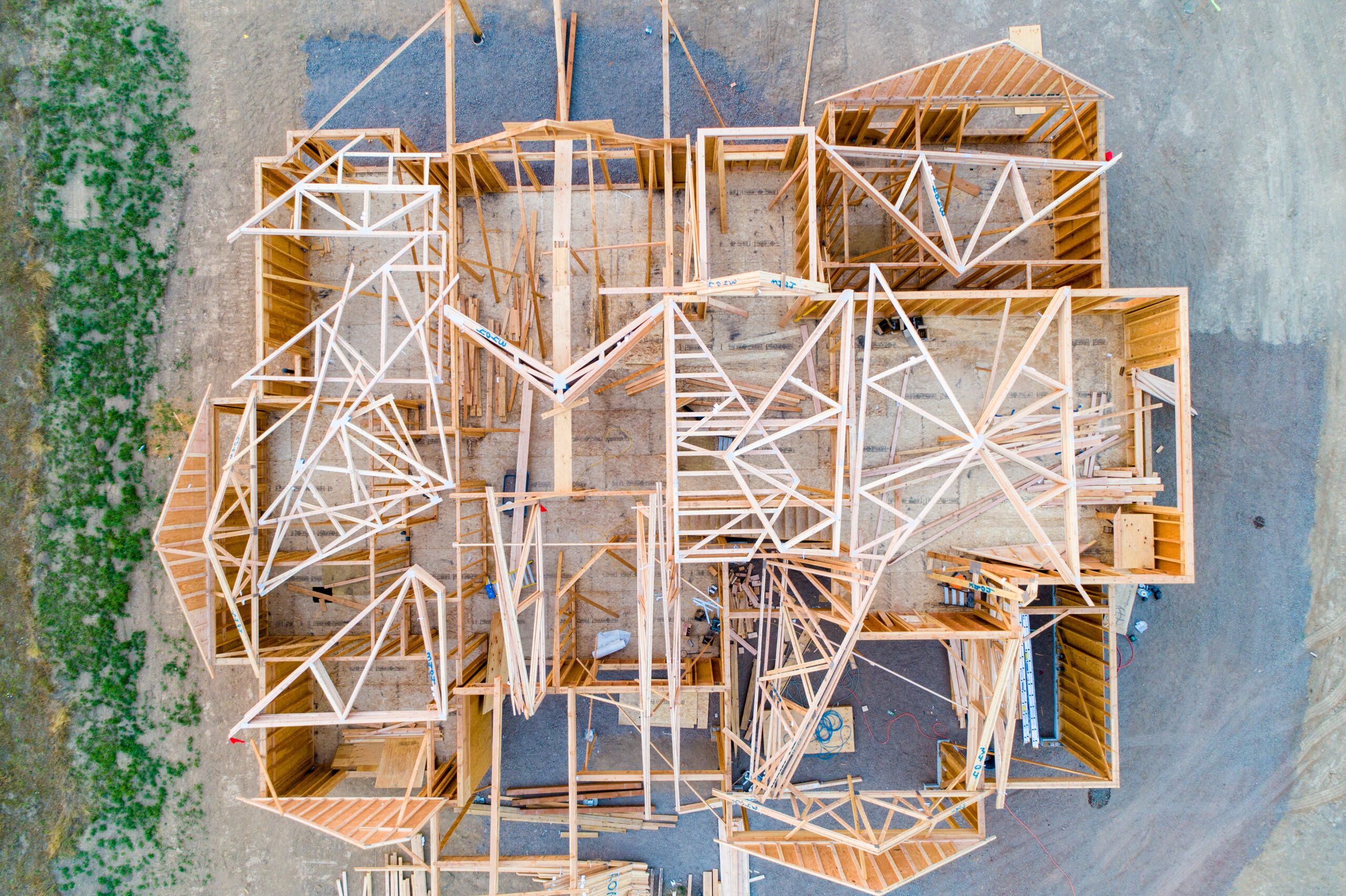

Purchasing a house or unit before completion is commonly called purchasing a property in the pre-construction phase. Opting for pre-construction buying presents several advantages, including reduced maintenance needs, lower deposits, and bypassing expensive bidding wars in the real estate market. However, it is crucial to consider the risks of purchasing a pre-construction home. Knowing where to begin and what aspects to prioritize is of utmost importance.

What Is a Pre-Construction Home?

A pre-construction home refers to a property that buyers purchase before its construction. It involves investing in real estate based on plans and designs for a property yet to be constructed. Generally, buyers purchase the land from the builder, although it’s also possible to purchase land from other suppliers. Buyers decide by considering the blueprint, layout, and specifications the developer or builder provides. One of the advantages of buying a pre-construction home is that it allows for customization.

Things to Think Before Purchasing a Pre-Construction Home

The current and future of the community

Purchasing a pre-construction property means investing in something that doesn’t exist physically. When signing the contract, the community might not be fully established, lacking essential facilities like childcare or medical centers nearby, limited public transportation, and no shopping mall. The timeline for moving into your new home can sometimes take several years, and it may even take longer for the entire community to be fully completed. Therefore, viewing this type of purchase as an investment rather than a typical resale transaction is crucial.

Builder History

It’s easy to get carried away with the excitement of buying a pre-construction home. The captivating marketing tactics and the allure of something new can sometimes cause us to overlook important factors. However, it is crucial to thoroughly research the developer before making any commitments. Take the time to check with the relevant regulatory authority in your province to verify the builder’s credentials and certifications and whether there are any records of complaints or disciplinary actions against them. Additionally, search online for any news or information about the builder, and confirm their licensing and certifications. Seeking references from previous clients or visiting completed projects can also provide valuable insights. Another option is to hire a professional inspector from a third party to assess the builder’s craftsmanship and inspect their previous projects. These steps will help ensure a more informed decision when buying a pre-construction home.

Move-In Delays are common

Move-in delays are typical for pre-construction homes and can be attributed to various factors. Obtaining permits and approvals from local authorities can sometimes take longer than anticipated. Unforeseen construction delays may arise due to adverse weather conditions, labour shortages, or unexpected technical issues. In rare cases, there is a risk of developer-facing financial difficulties, potentially leading to the loss of deposited funds. Additionally, the completion of community infrastructure and services, such as roads, utilities, and amenities, may need to catch up with the construction of individual homes. Homebuyers must understand that move-in delays are typical in the pre-construction home market.

Hidden Closing Costs

Closing costs encompass homebuyers’ extra expenses when completing a property purchase. These costs can include but are not limited to legal fees, land transfer tax, title insurance, home inspection fees, and adjustments and prepaid expenses. It is worth noting that buyers have the option to protect themselves by setting a limit on the closing costs within their contract.

HST

If you plan to buy the home as your main residence, there’s a possibility of qualifying for HST rebates based on the location. However, it’s crucial to note that if you’re an investor purchasing the property for generating income, you won’t be eligible for HST rebates. It’s important to thoroughly comprehend your financial responsibilities before completing the agreement.

Current HST in Canada

- 13% (HST) in Ontario

- 15% (HST) in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island

Uncertain Market Value

Purchasing a pre-construction home involves an uncertain delivery date. Although you can anticipate receiving your new home within a few months to years, there is no assurance that its value will match or surpass the amount you paid to the developer. As a result, buyers bear the risk of market fluctuations and potential losses if the market value of the property declines.

Cooling Off Period

When you buy a new Condo, you may have ten days to terminate the sales agreement. However, if you purchase a freehold property directly from a builder, there is no 10-day cooling-off period. It is highly recommended to thoroughly review your purchase agreement and have your lawyer negotiate the terms before signing. It is crucial always to retain your lawyer to represent your interests during the closing process.